Merry Christmas To All Of You

(Updated on Aug 04, 2023 By M.K.B)

Let us have some information about most applied loan type Payday Loans:

What Are Payday Loans?

Payday loans are generally short-term loans, starting from 100$ to $500 or sometimes reaching $1000. It is normally due on the borrower’s next payday. Most payday loans have some key features:

• Available for small amounts only.

• Due within one or two weeks of consumers' next payday.

• Borrowers provide access to lenders of their account status or credit history.

• Usually not offers to borrowers without checking their ability to repay the debt.

It can be instalment based or can have renewal points. Yearly rate rates (APRs) on these credits can extend from two fold-digit; close prime rates to as high as 800 percent.

For some shoppers,payday credits have filled in as a wellspring of included methods during times of money-related hardship. While these significant expense advances do give people a brief wellspring of quick assets, they likewise trap numerous individuals in an obligation cycle.

Borrowers as a rule qualify effectively and are endorsed for these advances, at that point are later astonished by the sudden monetary weights that outcome from their choice to get to this type of credit.

Why to Choose Payday Loans in Texas?

Numerous borrowers see payday credit items as their lone methods for endurance during times of money-related hardship. As indicated by the

Center for Financial Services Innovation (CFSI), a great many people use payday advances to cover sudden costs, skewed income, arranged buys or periods where they have surpassed their pay.

In a CFSI In a CFSI review, 67 percent of borrowers referred to one of these reasons as the essential driver for their payday advance utilisation, while the remaining 33% of borrowers referred to at least two reasons. Most overview respondents distinguished startling costs and surpassing their pay as the primary sources for their utilisation of this sort of credit.

Payday Lenders in Texas

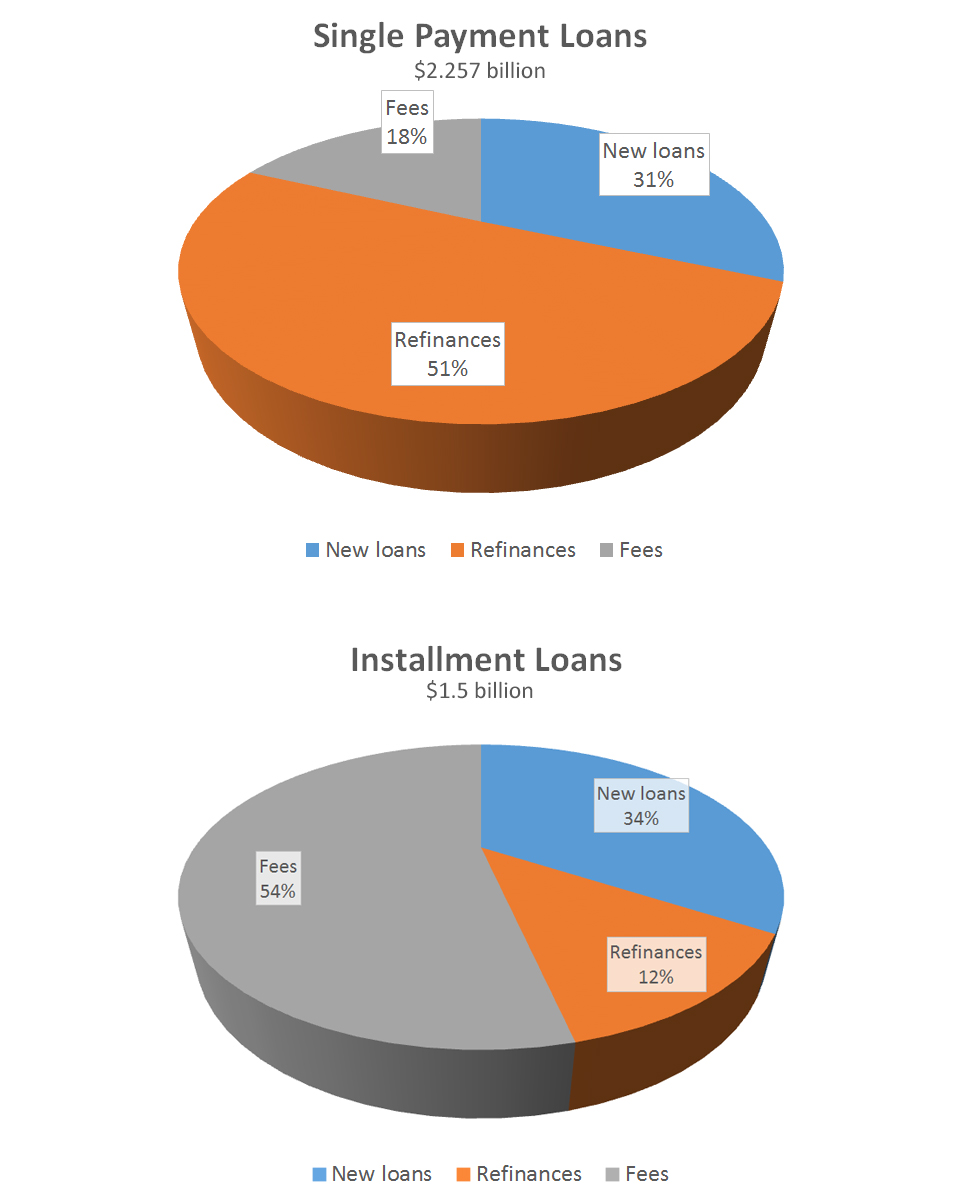

For both single-instalment and portion credits, expenses and renegotiates represent 66% of the income of the payday lending industry in 20232 (Chart 1).

Single-instalment credit borrowers regularly had more prominent trouble reimbursing their advances, which brought about the greater part of this present class' income originating from renegotiates.

Alternately, because of the significant expenses related to portion credits in Texas, most of the income in this advance order was from expenses charged by banks.

This dissemination reflects what national investigations have additionally found in different markets over the U.S.—that for every borrower, the advance chief represented just a little division of the absolute credit balance, contrasted with the advance expenses charged.

During 2023, the majority of payday advances were for chief sums somewhere in the range of $250 and $500.

Chart 1 Refinances and Fees Generated Most Revenue for Texas Payday Lenders in 2023

SOURCE: Credit Access Business (CAB) Annual Report, Texas Office of Consumer Credit Commissioner.

How to apply for Payday Loans in El Paso for Christmas Celebrations?

As very few days are left for Christmas, the celebrations have begun from now and will continue till New Year. So, Payday Sunny has

brings you the special offers on Payday Loans in Texas to help you enjoy your

festival as per your wishes.

On the off chance that you are looking through online payday loans in El Paso TX,

at that point at Payday Sunny is the main extraordinary decision for you. It is very hard when you coming up short on money and not locate a

brisk arrangement and confronting startling crises. We offer quality answers for take care of these surprising issues with advances El Paso of

Payday Sunny.

Just Payday Sunny can enable you to out when you need payday advances El Paso, Texas with no credit check.

Applying a bank credit may devour your important time – yet payday advances online are a simple choice for you in El Paso.

Note: To Apply loans in Las Vegas