Laws for Online Payday Loans in Illinois

(Posted on Aug 31, 2023 By M.K.B)

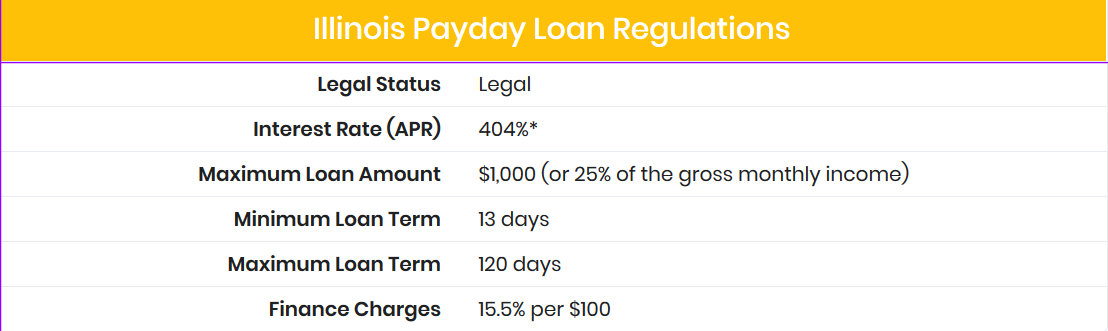

Payday Lending is Legal in Illinois

Illinois has a breaking point on the measure of an old-style payday advance: $1,000 or 25% of the gross month-to-month salary, whichever is less. Credits can be taken from 13 days as long as 120 days. Account charges ought not to surpass 15.5% per $100 obtained. Nonetheless, the actual APR in the state approaches 404%*. Criminal activities are disallowed.

The territory of Illinois offers 3 payday credit items right now: a little customer advance with an APR not over 99%, payday portion advances that last as long as a half year and have an APR up to 400%, and payday advances (as indicated by the site of Illinois Attorney General).

These guidelines concerning the business were presented 9 years back after HB 537 passed and got powerful on March 21, 2011. It corrected the Payday Loan Reform Act (PLRA) to make Installment Payday Loans and it additionally altered the Consumer Installment Loan Act (CILA) to make Small Consumer Loans.

Illinois Payday Lending

Payday loaning is viewed as lawful in the territory of Illinois (815 ILCS 122/1-1 et seq.).

The Illinois Department of Financial and Professional Regulations (IDFPR) keeps a database of all Illinois payday advances. It is necessitated that all banks check the database before giving another credit to a buyer and furthermore enter the data with respect to the new advanced sorts into the database. The database was made with the plan to wipe out harsh acts of payday loaning and carry more requests into the business.

Loan Limits in Illinois

"No moneylender may make a payday advance to a shopper if the aggregate of all payday advance installments coming due inside the principal schedule month of the advance, when joined with the installment measure of the entirety of the purchaser's other remarkable payday advances coming due around the same time, surpasses the lesser of:

(1) $1,000; or

(2) on account of at least one payday credits, 25% of the purchaser's gross month to month pay; or

(3) on account of at least one portion payday credits, 22.5% of the purchaser's gross month to month pay; or

(4) on account of a payday advance and a portion payday credit, 22.5% of the purchaser's gross month to month pay." (815 ILCS 122/1-1 et seq.).

It is prohibited to take multiple credits one after another.

Most extreme term for a payday loans in Illinois

In Illinois, you one can take a payday advance for a term from 13 as long as 120 days.

Rollovers are denied particularly on the off chance that they are intended to broaden the reimbursement time of another payday credit.

A chilling period implies that you need to hold up 7 days following 45 days of having an advance (aside from portion payday credits.)

Otherwise, you won't get the following advance.

A portion payday advance ought to be offered for a time of at least 112 days and not surpassing 180 days.

Customer Information

Criminal allegations are disallowed in the territory of Illinois.

If there should be an occurrence of NSF to pay a check, a loan specialist may charge an expense not to surpass $25.

"(f) A bank may not take or endeavor to look into any of the customer's close to home property to verify a payday credit."

(815 ILCS 122/1-1 et seq.).

TheIllinois Department of Financial and Professional Regulations (IDFPR) regulates the

payday lending industry in the state of Illinois.

How we can help you?

We, at Payday Sunny, have streamlined credits decision just for you! We grasp that the

progressed salaried individual doesn't have a great deal of time close by. In any case, much equivalent to an individual may

require money in a succinct moment; he more likely than not won't wish to spend a long time getting it.

Our credit application process is straightforward, we have been told, and we put wholeheartedly into it. Search for after these methodologies and preferred position payday advance on the web.

Top off the online structure. The online application is open on our website 24 hours and 7 Days A Week Pay Day Loans. Essentially fill in with your own unique nuances relating to your name, age, email ID, telephone number, and obviously, in case you are working or not. There are other fundamental nuances that you should fill in with mind and a short range later snaps on submit.

Screen things for a couple of moments to hours for us to find the right match from our embellishment loan authorities. They couldn't consider your FICO rating or anything. Each credit pro will have their financing cost for you close to the approach for compensation that you have. We will provide it for you through email.

See and watch out for the one you wish to have as your moneylender and the procedure is done. Right when you just respond to the mail with the money moneylender's name, your headway will land at your record in only 24 hours characteristics or as indicated by all accounts.

Note: Reasons to Take out Payday Loans in Texas